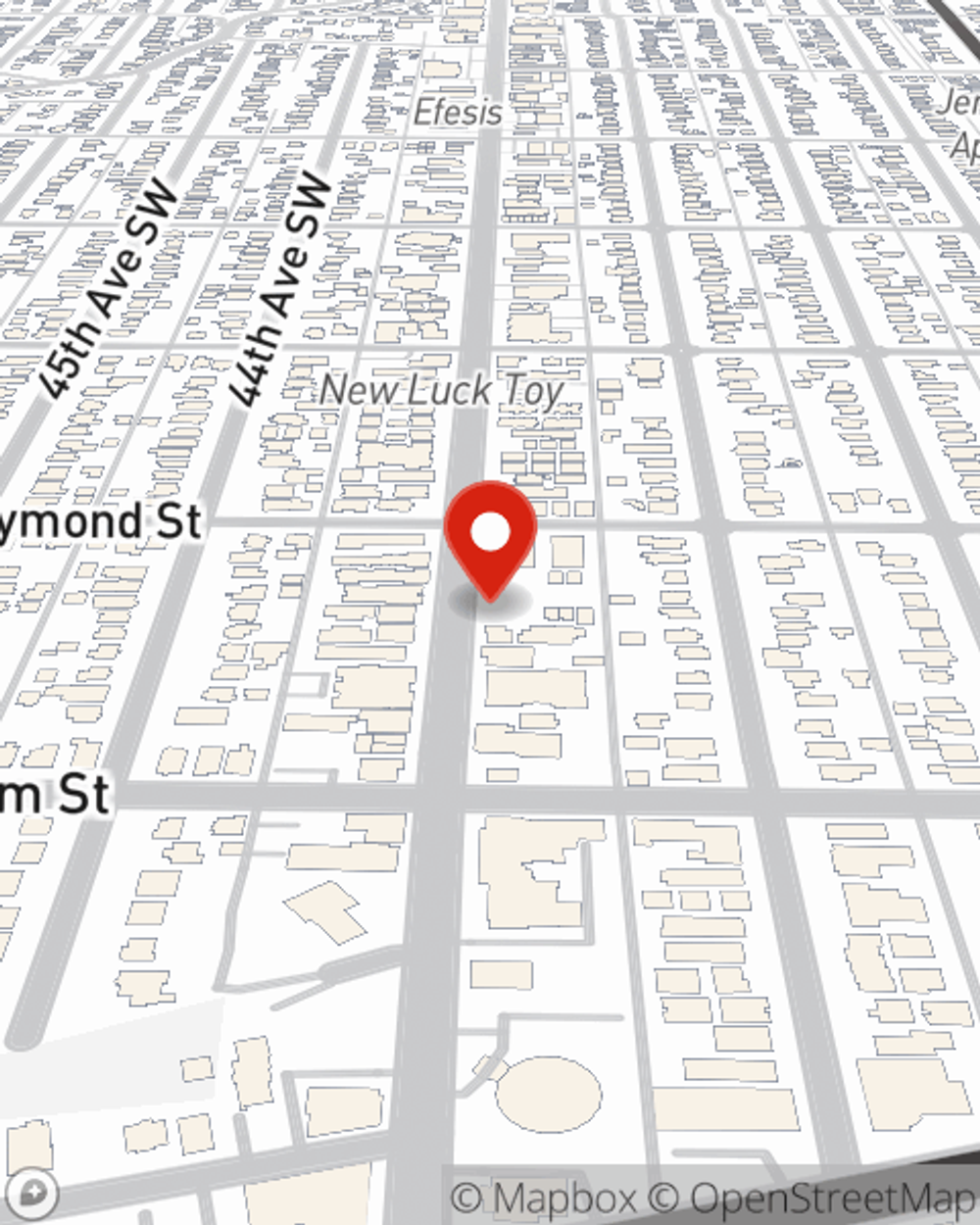

Business Insurance in and around Seattle

One of Seattle’s top choices for small business insurance.

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of challenges. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, a surety or fidelity bond and extra liability coverage, among others.

One of Seattle’s top choices for small business insurance.

Cover all the bases for your small business

Get Down To Business With State Farm

Whether you own a home cleaning service, a bakery or a lawn care service, State Farm is here to help. Aside from remarkable service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Brian Chambers is here to talk through your business insurance options with you. Visit with Brian Chambers today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Brian Chambers

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.